Enterprise Case Management (ECM) – Transforming Investigations

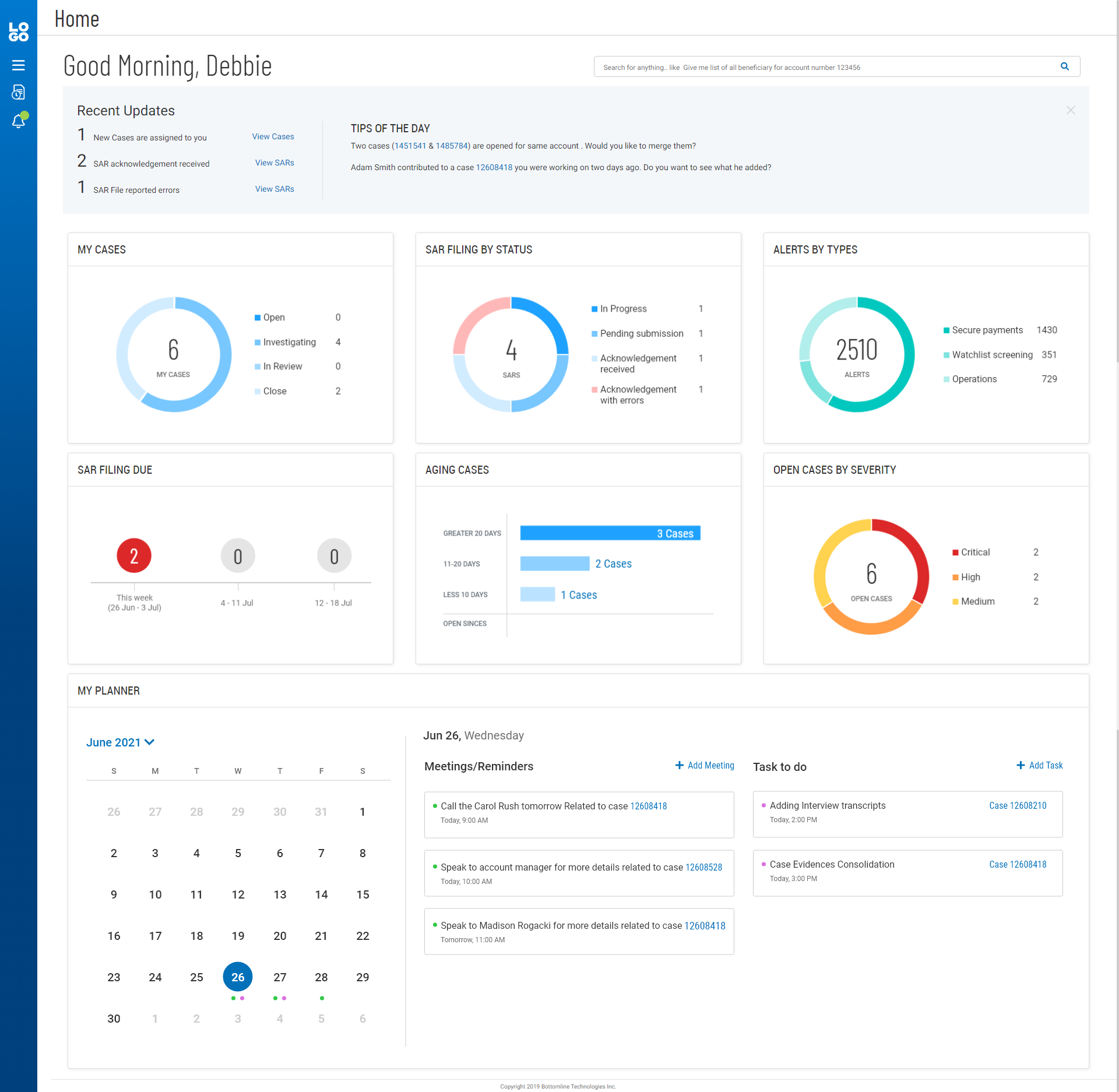

Enterprise Case Management (ECM) is a scalable platform for banks, financial institutions, and insurers to investigate and track fraud cases. It streamlines anti-money laundering, fraud detection, and compliance, including SAR filing.

Investigators faced challenges in ECM due to:

- Lack of a 360-degree case view, making it hard to track key details.

- Manual data entry, as the system didn’t auto-fetch related information.

- An outdated UI that lacked intuitive workflows.

- Limited visualization tools, making it difficult to identify fraud patterns.

- Dependence on external tools for note-taking, reducing efficiency.

This large-scale project aimed to redefine the case management experience. The first phase of designing focused on UI structure, user workflow, and automation.

- Designed UI strategy around investigator workflows and pain points.

- Developed low-fidelity wireframes and conceptual workflows for better case tracking.

- Created interactive prototypes for stakeholder validation.

- Planned data visualizations.

- UX Lead: Led research, conducted user interviews.

- UX Designer (My Role): UI Strategy, Wireframes, Visuals

User & Design Strategy

Case Investigators working in banking and financial institutions who handle fraud and compliance cases.

- Seamless case tracking from fraud detection to resolution.

- Automated data population to minimize manual efforts.

- Enhanced visual analysis for connecting suspects, accounts, and transactions.

- Quick decision-making tools to determine whether a case requires escalation or SAR filing.

Research & Discovery

- Over-the-shoulder observations of real investigations

- Analyzed current workflows to identify inefficiencies.

- Studied competitor solutions and industry standards for case management.

Ideation & Prototyping

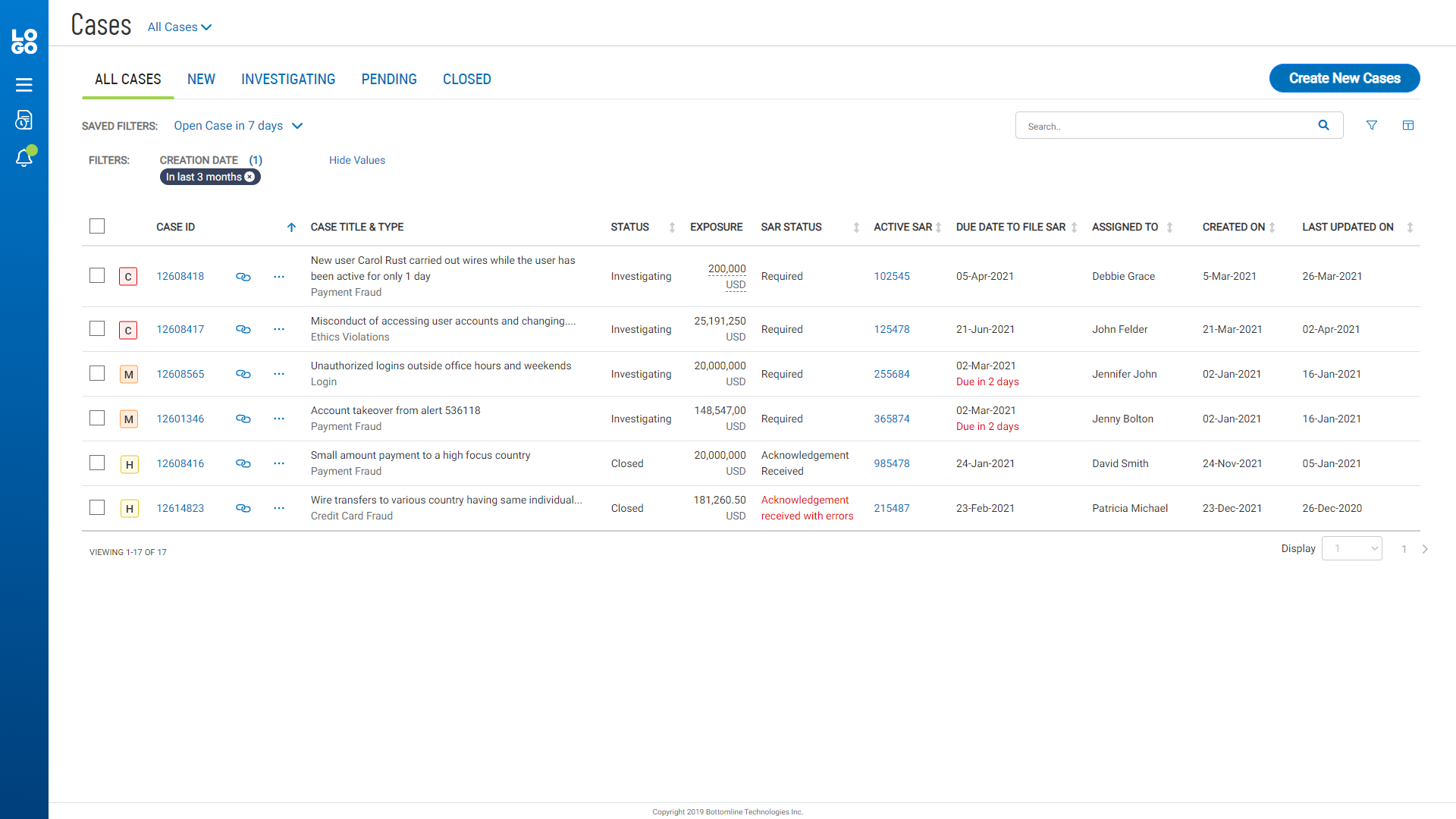

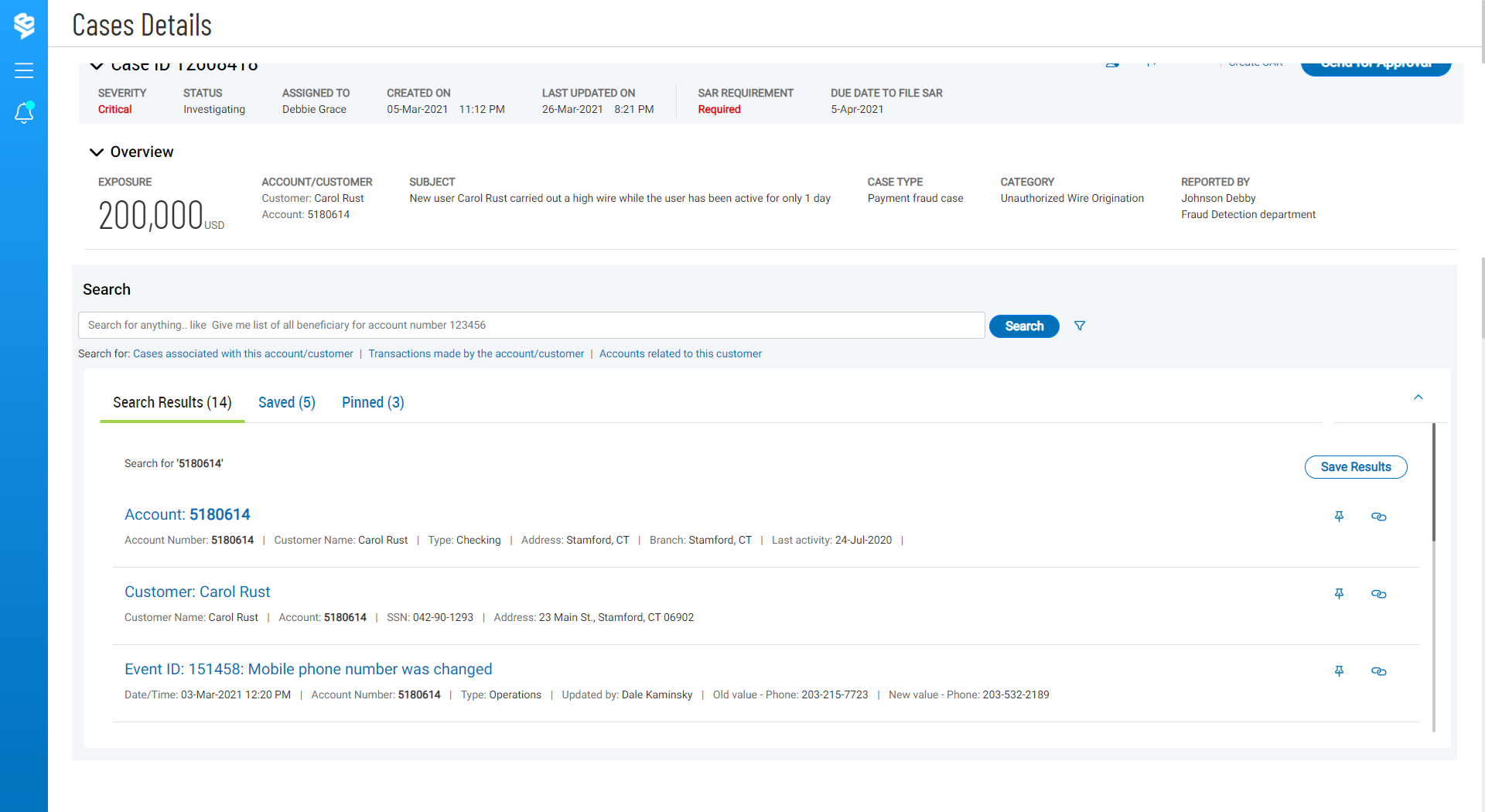

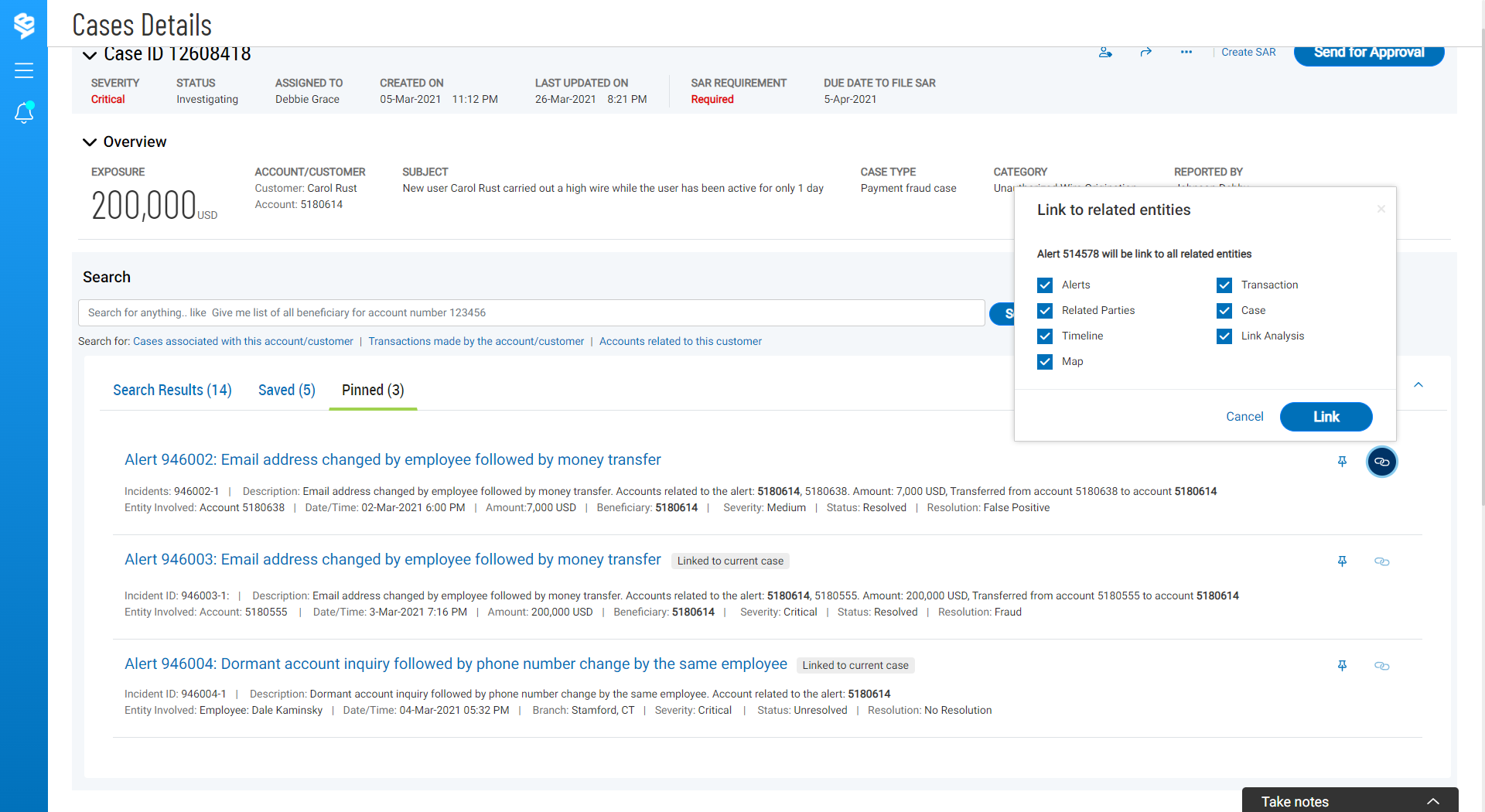

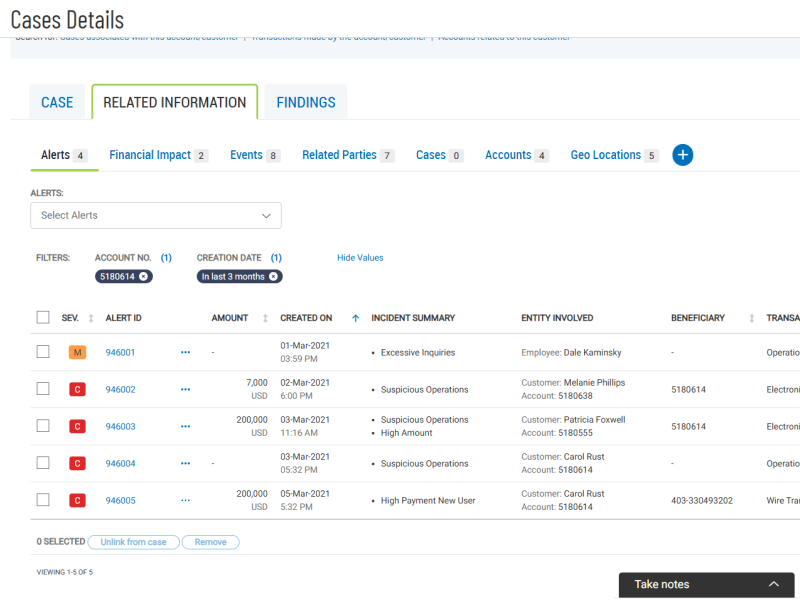

- Designed wireframes for a structured case view, integrating all related alerts, transactions, and parties.

- Created interactive prototypes with automated data fetching and smart recommendations.

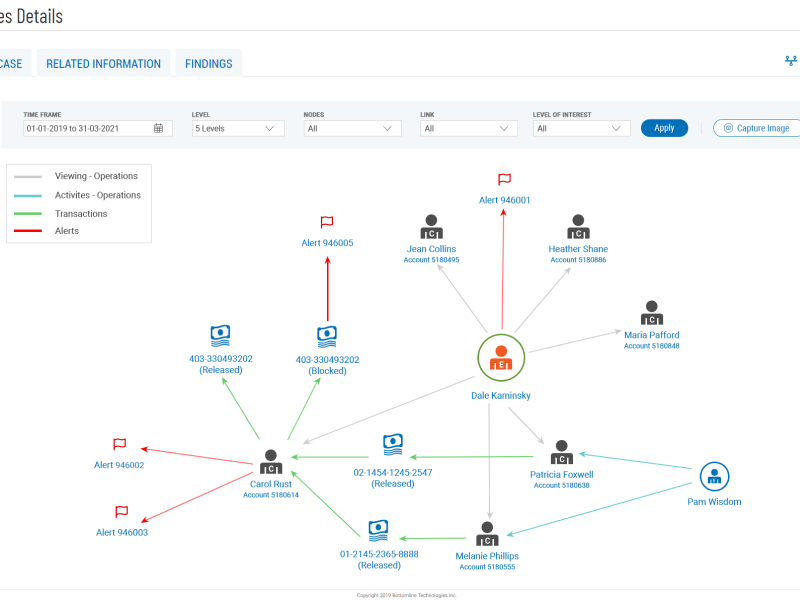

- Designed a visual link analysis tool to help investigators connect fraud patterns more effectively.

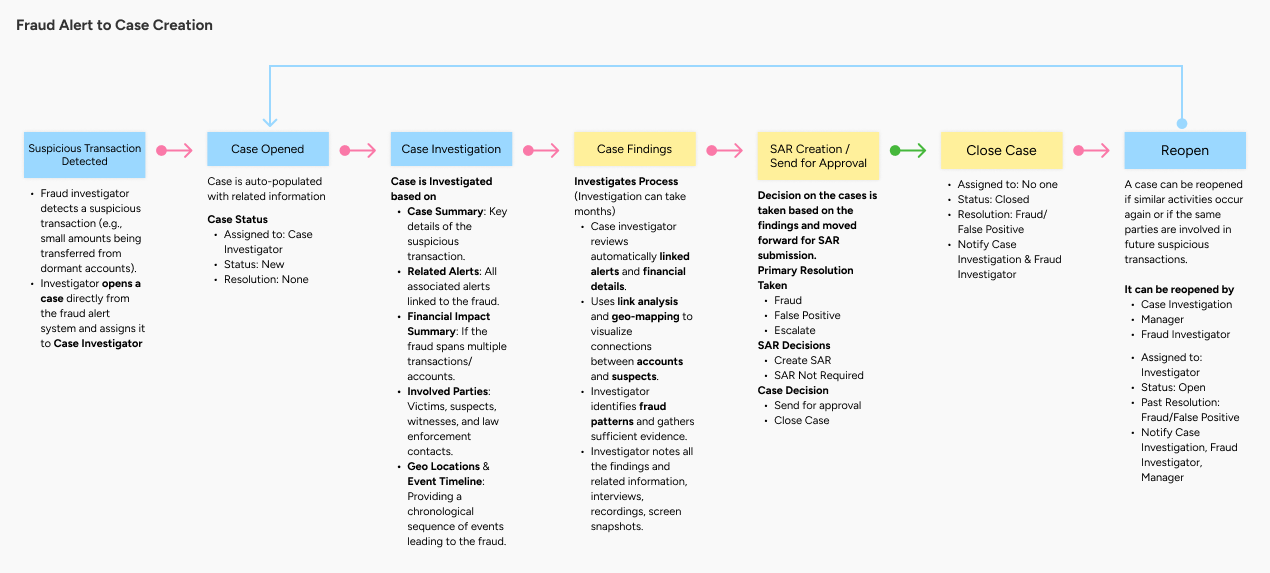

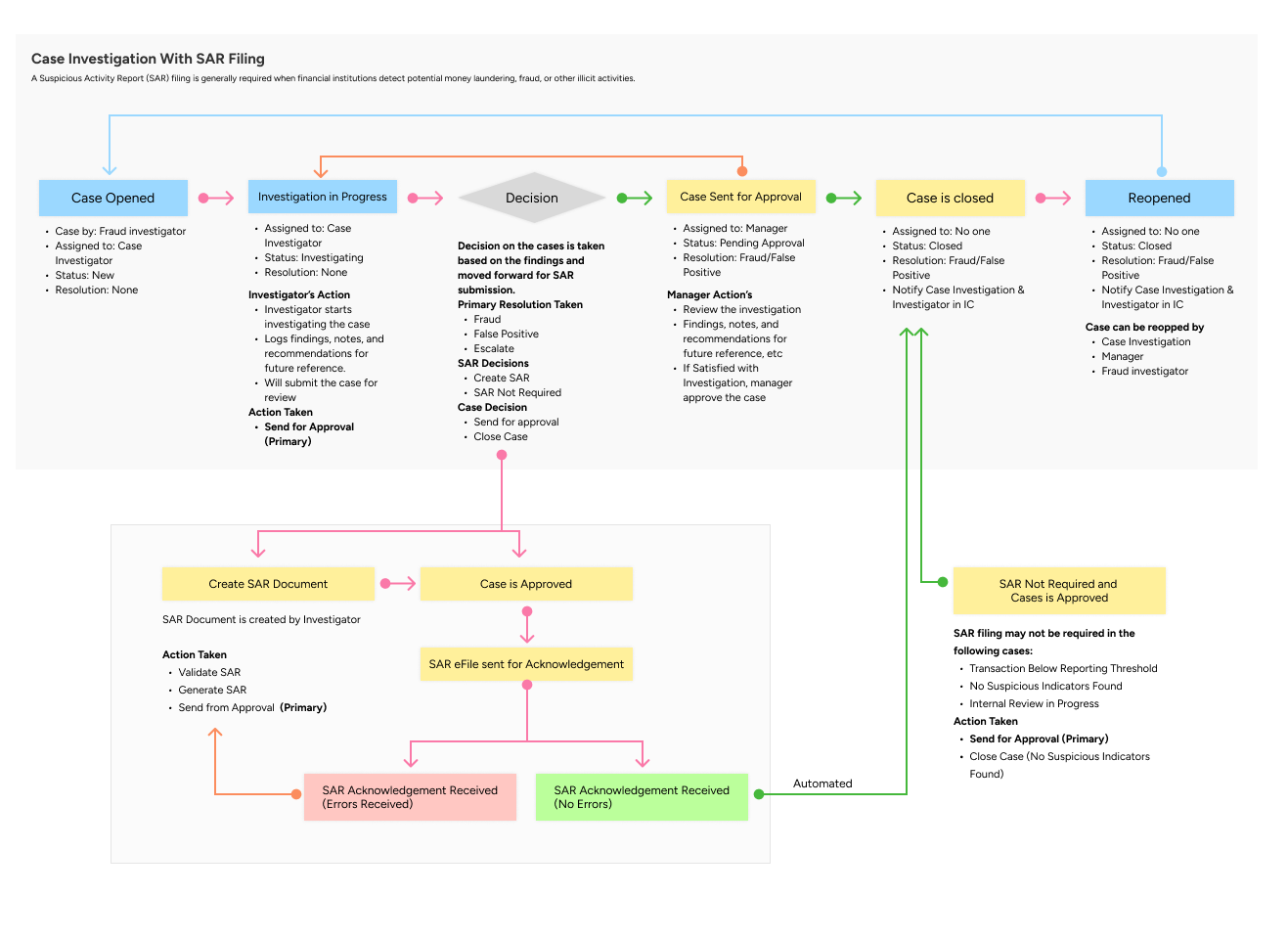

Investigation Workflow

Flow 1: Fraud Alert to Case Creation

Flow 2: Case Investigation with SAR Filing

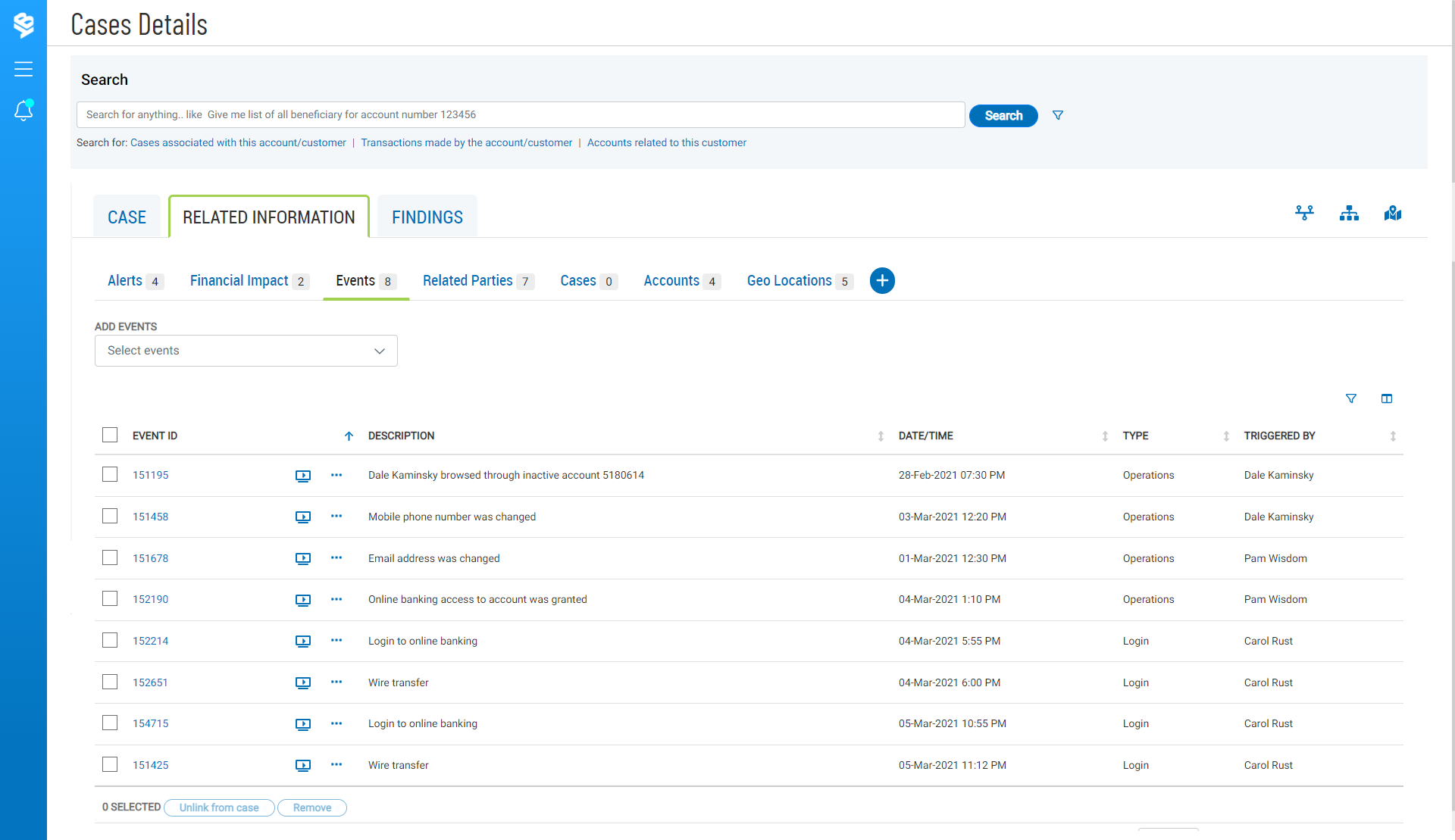

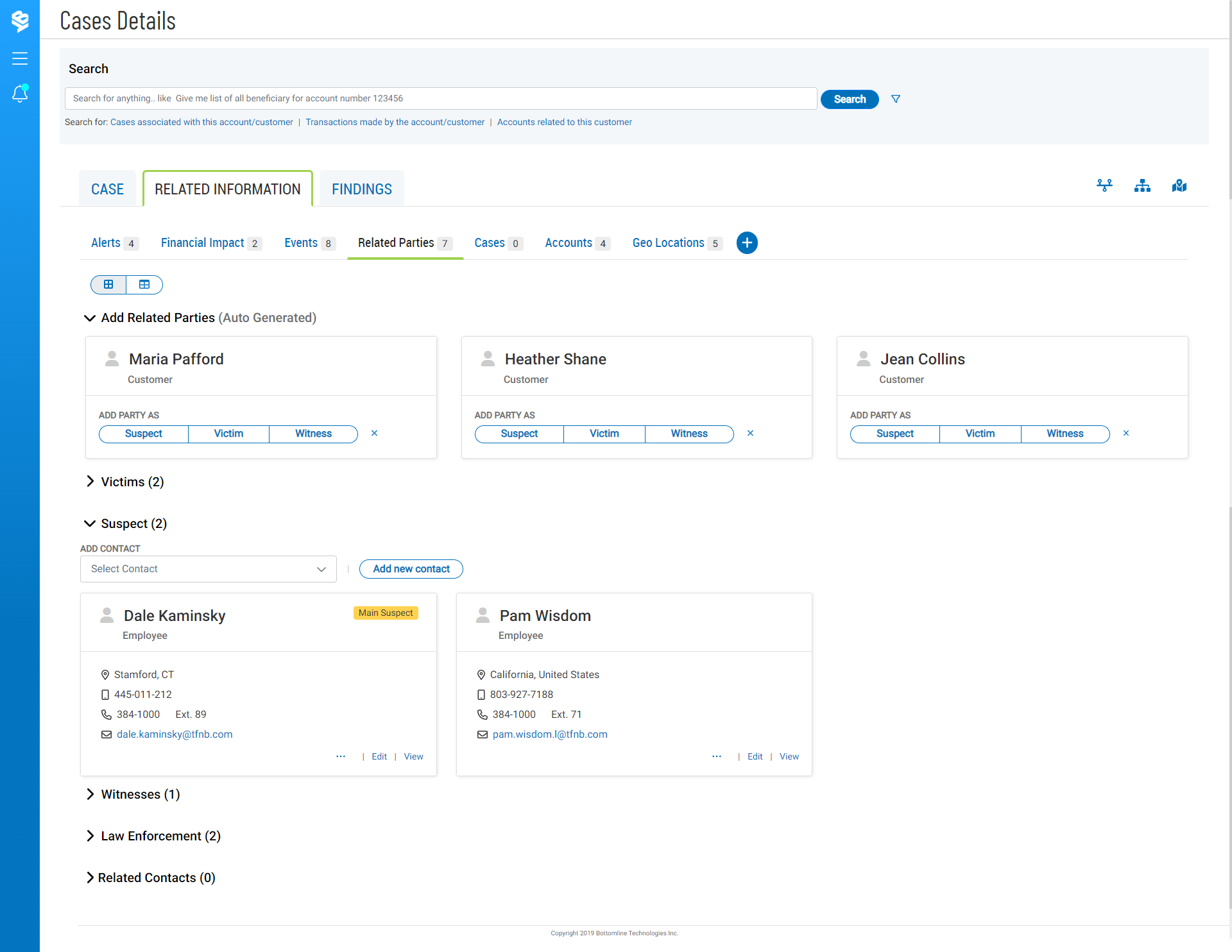

Key Features & Enhancements

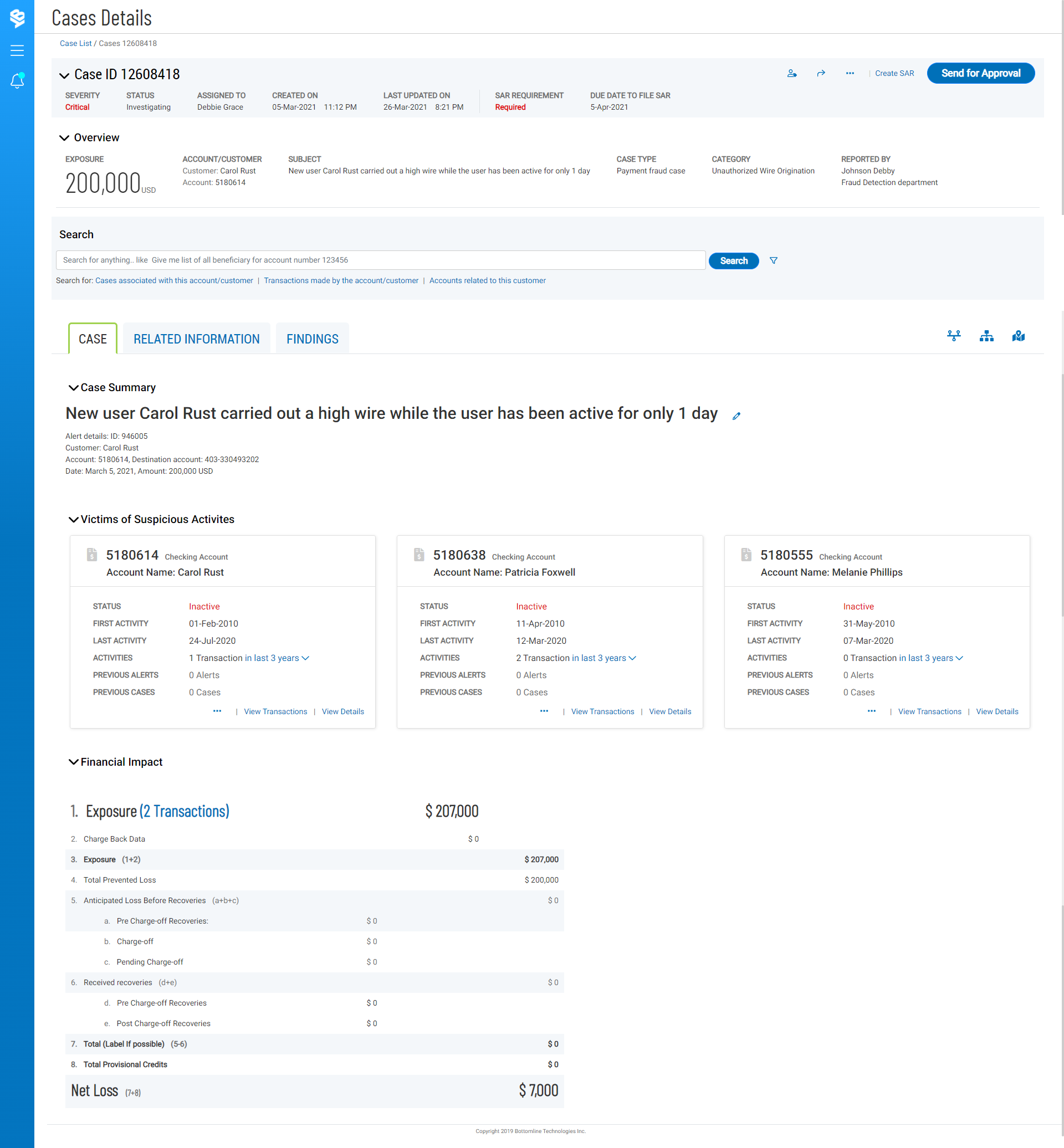

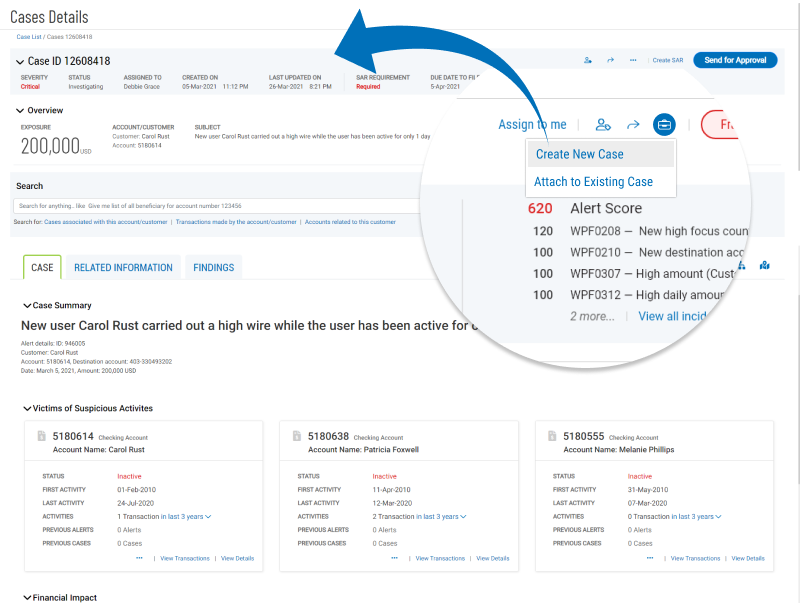

Smart Case Automation

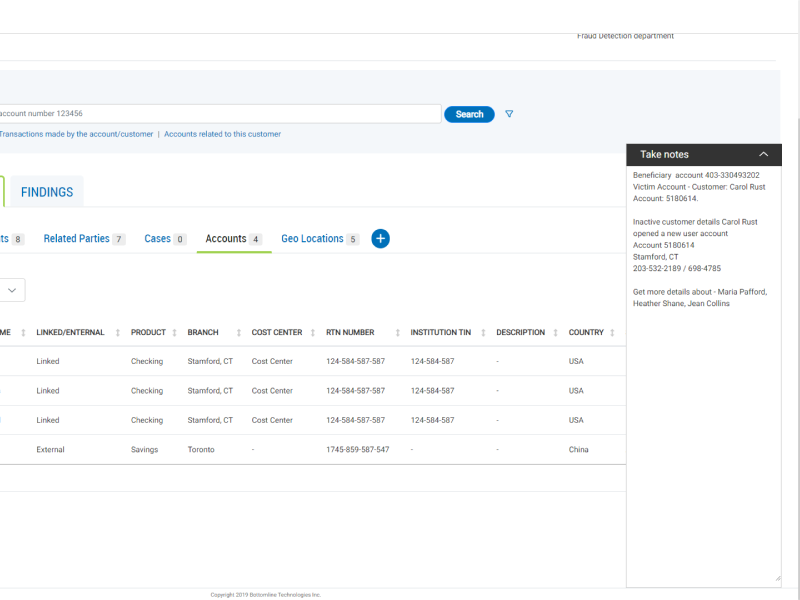

When an investigator opens a case from the fraud alert system, all related information—including visuals—auto-populates across the case, reducing manual effort and ensuring a complete view.

Google Like Search

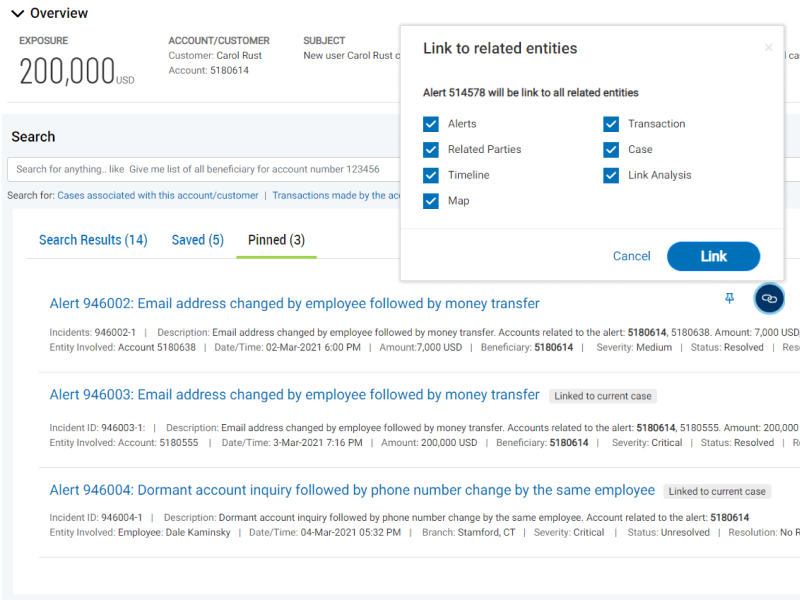

Designed a natural language search concept to help users find, save, pin and attach relevant results effortlessly. The system intelligently categorizes data, updating related sections and visuals automatically.

Quick Notes & To-Do List

During user research, we observed investigators taking notes externally. To streamline this, we introduced quick in-app note-taking that automatically integrates into findings, allowing refinement later. Planned a built-in to-do list feature to help users track and manage their tasks effortlessly.

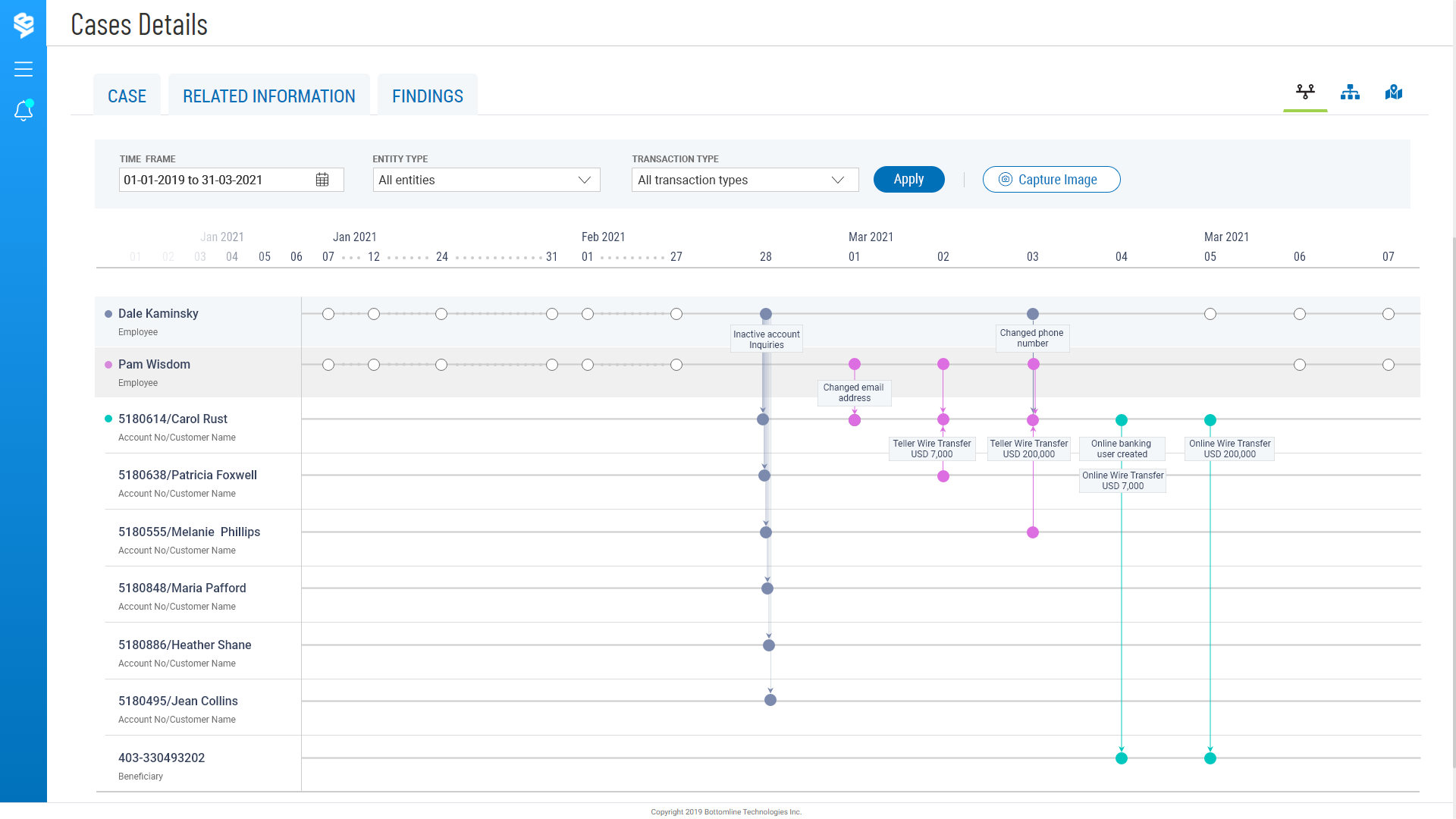

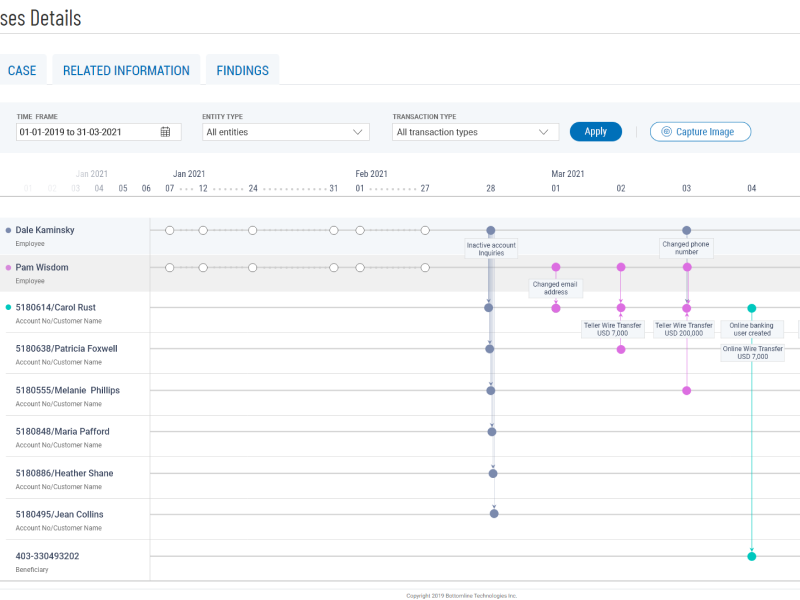

Timeline Visualization

A visual timeline of key events enhances investigation clarity, moving beyond static data to an interactive view. (Planned integration with third-party tools.)

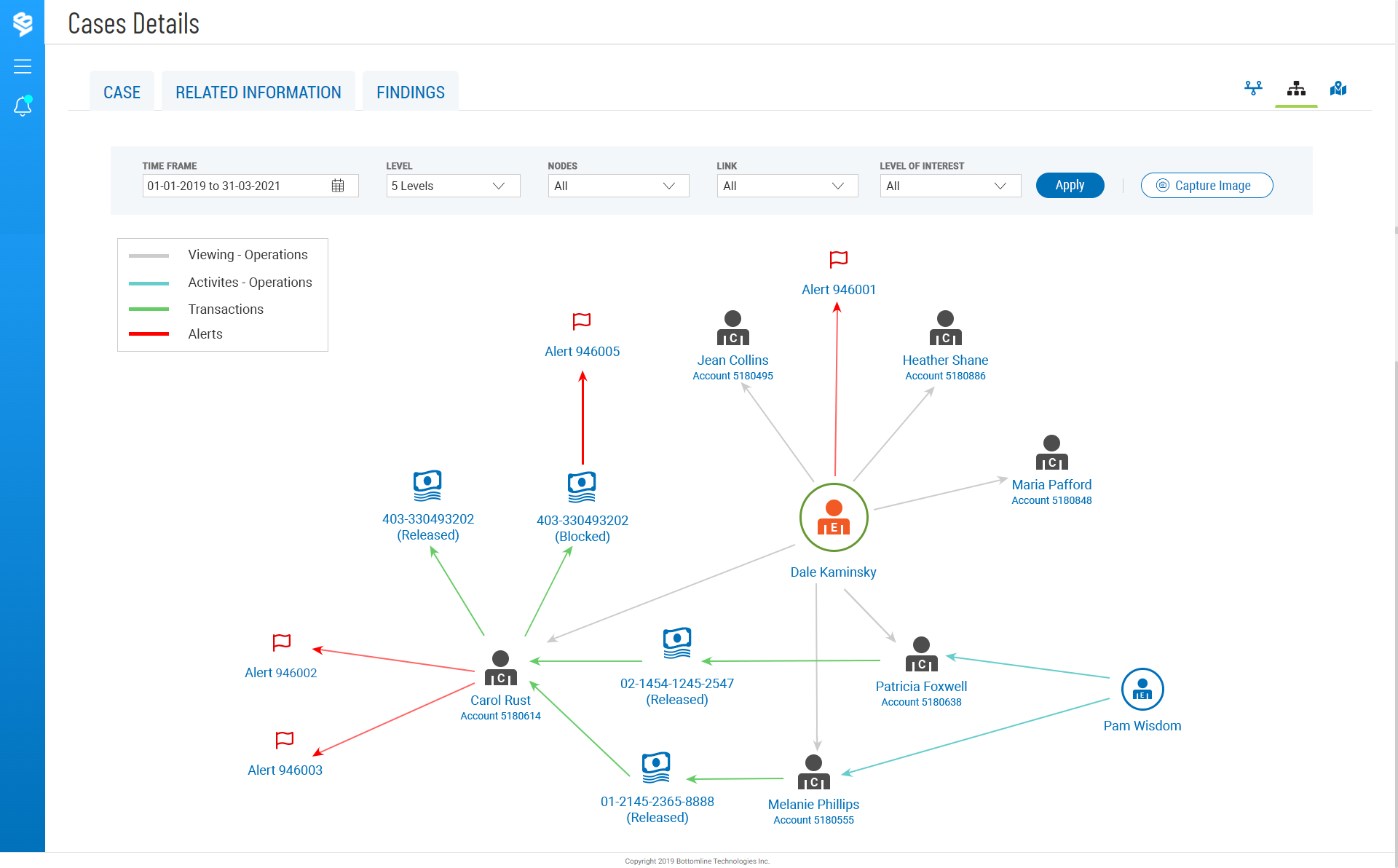

Enhanced Link Analysis

We planned to improve relationship mapping between involved parties, providing a more intuitive and enriched visual representation of connections.

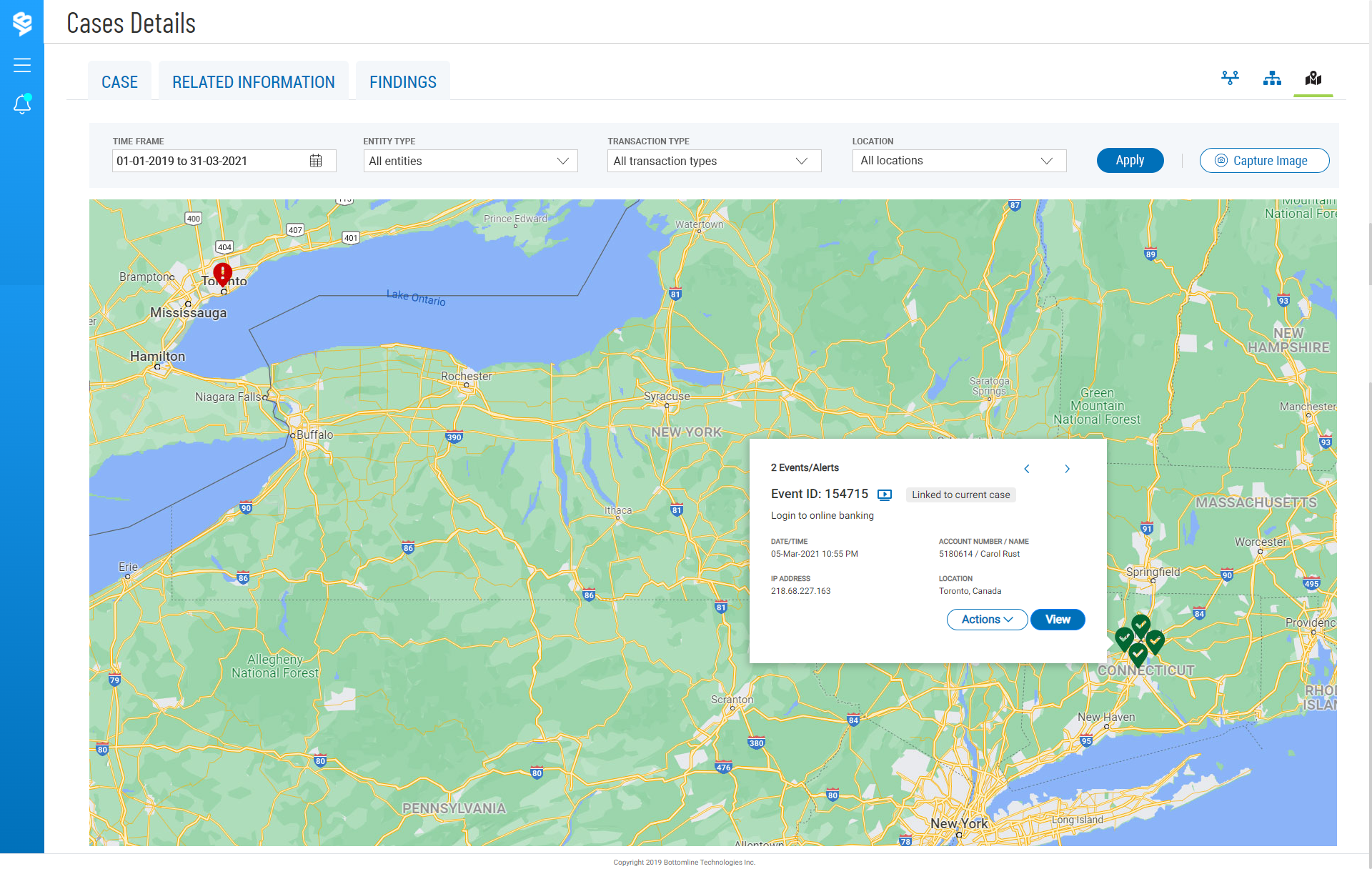

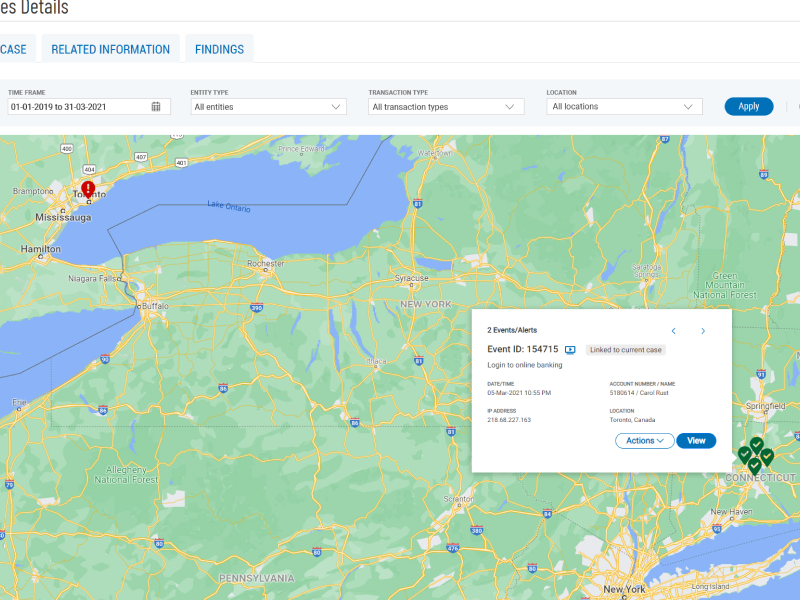

Geo-Location Mapping

Instead of static data, we introduced an interactive geo-mapping experience, offering investigators a clearer spatial view of all involved parties.

Seamless Cross-Platform Integration

Fraud investigators can escalate alerts into cases with full context, ensuring a smooth handoff and reducing redundant data entry.

Final Outcome & Conclusion

- Faster investigation process due to reduced manual data entry.

- Improved fraud detection efficiency with enhanced visualization tools.

Conclusion

- Although this was a promising project, it remained in the ideation phase due to shifting priorities. The foundation was laid for a modern, investigator-friendly case management system, with significant improvements in efficiency, automation, and user experience.